What is Wage Parity

Wage Parity Law

What It Is

In accordance with the Home Care Worker Wage Parity Act, as of 2012, employers in New York City and its surrounding counties are mandated to provide a living wage to home care workers. Our mission is to make it easy and affordable for companies to comply with this act.

How It Works

The 2025 total compensation for employers in New York City consists of a Base Wage of $19.10 and a benefit portion of $2.54. Total compensation for employers in the counties of Nassau, Suffolk, and Westchester consists of a Base Wage of $19.10 and a benefit portion of $1.67. According to Section 3614-C of the New York State Public Health Law, or the Home Care Worker Wage Parity Law, the Base Wage must be satisfied by actual monetary wages, whereas the benefit portion may be satisfied by providing pension benefits, health insurance, dental & vision benefits, or transit benefits.

Wage Parity Solution allows those benefits to be distributed and managed in compliance with the Wage Parity Law and provides effortless access for employees to their benefit plans.

New York City & Surrounding Counties -Wage Parity Rates

New York City

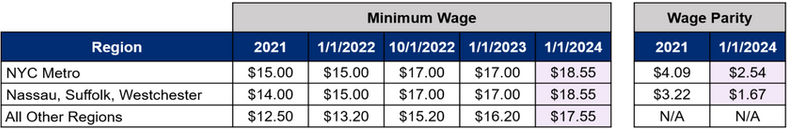

For the period of January 1, 2024, through December 31, 2024, the hourly minimum rate for home care aide total compensation (Total Compensation) will be $21.09 in New York City. This consists of a cash portion (Base Wage) of at least $18.55 set forth by the Department of Health, and a benefit portion of up to $2.54 per hour (Image 1).

(Image 1)

Total Compensation may be satisfied entirely through wages, or through a combination of wages, additional wages, and supplemental wages, with the following limitations:

The Base Wage is the minimum amount of the Total Compensation that must be paid in cash wages directly to the home care aide as regular hourly wages for all hours worked.

Additional Wages are the amount of the Total Compensation that employers may satisfy through additional payments directly to home care aides for hours not worked and for differentials and premiums other than overtime. Examples include paid leave (vacation, holiday, sick, and personal days) and differentials or premiums for certain shifts (nights, weekends, and holidays) or assignments (sleep–in or live–in work, care for multiple clients during the same shift). Additional Wages do not include overtime compensation required under the Fair Labor Standards Act (FLSA), State minimum wage orders, or extra compensation creditable toward required overtime compensation for hours worked in excess of normal, regular, or maximum daily or weekly hours. The Additional Wage portion can also be satisfied by increasing the Base Wage or Supplemental Wages by a corresponding amount.

Supplemental Wages are the amount of Total Compensation that employers may satisfy indirectly, for example, by providing education, pension benefits, or health insurance required by federal law. The Supplemental Wages portion can also be satisfied by increasing the Base Wage by a corresponding amount.

Overtime is required at 1½ times the regular rate of compensation under the FLSA as well as under the New York State Labor Law´s provisions for minimum wage and for domestic workers. The exceptions to this general rule that applied to most employers of home care aides and to certain non–profits prior to 2015 no longer apply to third-party employers, such as home care agencies, as a result of the FLSA overtime Home Care Final Rule issued on October 1, 2013, amending 29 C.F.R. § 552 at 3, 6, 102, 109 and 110. For more information visit www.dol.gov/whd/homecare

Outlook

The budget for upcoming years delineates significant alterations in compensation for home care workers in New York State, impacting both the wage parity benefits and the hourly wage components. Starting from 2024, there will be incremental adjustments to the minimum wage rates for home care workers across the state.

For home care workers in both NYC and its surrounding counties, the minimum wage is set to rise from $17.00 in 2023 to $18.55 in 2024, reaching $19.65 by 2026. Additionally, there are changes in the NYC Wage Parity Benefit Rate, decreasing from $4.09 to $2.54, effective from 2024. Consequently, the total compensation for NYC workers remains at $21.09 in 2024 but will increase gradually to $22.19 by 2026. In Nassau, Suffolk, and Westchester counties, the Wage Parity Benefit Rate will decrease to $1.67, with total compensation increasing from $20.22 in 2024 to $21.32 by 2026 (image 2).

(Image 2)

These adjustments reflect a commitment to ensuring fair compensation for home care workers while balancing the financial responsibilities of employers. The aim is to enhance the living standards of these vital workers, acknowledging their crucial role in providing essential care services. The Wage Parity Solution remains a pivotal tool in managing these transitions, offering seamless compliance and benefits management for both employers and employees in this sector.